st louis county personal property tax calculator

Louis County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Pay your Property Taxes.

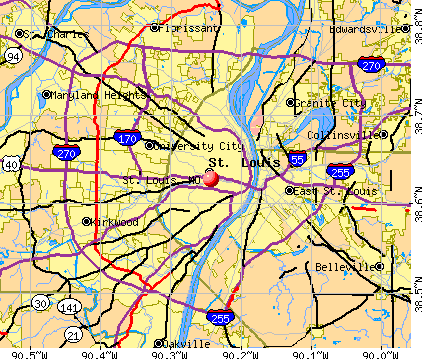

10 Best St Louis Suburbs Trendy Suburb Of St Louis Mo Map 2022

Monday - Friday 8 AM - 5 PM.

. The median property tax in St. November 15th - 2nd Half Agricultural Property Taxes are due. Louis City collects on average 092 of a propertys assessed fair.

Personal property is assessed at 33 and one-third percent one third of its value. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local. The states average effective property tax rate is 093 somewhat lower than the national average of 107.

Louis City Missouri is 1119 per year for a home worth the median value of 122200. The following calculators can assist you with. 15000 market value 3 5000 assessed value.

Louis County collects on average 125 of a propertys. To declare your personal property declare online by April 1st or download the printable forms. Mail payment and Property Tax Statement coupon to.

The median property tax in St. The current statewide assessment rate for personal property is 33 13. Please contact the State Auditors Tax Rate Section if you have any questions regarding the calculation of property taxes at 573-751-4213.

An original or copy paid personal property tax receipt or a statement of non-assessment from your county of residence or city of St. Charles County pays 2624 annually in. Programs to help with Taxes.

To determine how much you owe perform the following two-part. Account Number or Address. Taxes are imposed on the assessed value.

October 17th - 2nd Half Real Estate and Personal Property Taxes. 41 South Central Avenue Clayton MO 63105. Louis County Missouri is 2238 per year for a home worth the median value of 179300.

Louis County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Rates in Missouri vary significantly depending on where you live though. Change Taxpayer Mailing Address.

Personal Property Tax Calculation Formula. Account Number number 700280.

How Do You Know If You Qualify For The Missouri Property Tax Credit

Missouri Property Tax H R Block

Minnesota Property Taxes Explained Part 2 How Are Property Taxes Calculated Streets Mn

Clay County Missouri Tax A Resource Provided By The Collector And Assessor Of Clay County Missouri

Missouri Department Of Revenue

Mortgage Calculator Monthly House Payment

![]()

County Assessor St Louis County Website

Missouri Property Taxes By County 2022

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Print Tax Receipts St Louis County Website

Missouri Property Tax Calculator Smartasset

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Individual Tax Types Property Tax Credit

Missouri Income Tax Rate And Brackets H R Block

St Louis County Personal Property Declarations Deadline Extended